south dakota property tax rate

The South Dakota income tax has one tax bracket with a maximum marginal income tax of. We Provide Homeowner Data Including Property Tax Liens Deeds More.

North Dakota Officials Propose Flat Income Tax Rate Eliminating Individual Income Taxes For Most Taxpayers Inforum Fargo Moorhead And West Fargo News Weather And Sports

Dictated by South Dakota law this operation is supposed to allocate the tax burden in an even.

. The median property tax in Minnehaha County South Dakota is 2062 per year for a home. Ad Uncover Available Property Tax Data By Searching Any Address. The median property tax in Brown County South Dakota is 1661 per year for a home worth.

The median property tax in South Dakota is 162000 per. South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent. The median property tax in Kingsbury County South Dakota is 914 per year for a home worth.

The effective average property tax rate in South Dakota is. This surpasses both the. Median Income In South Dakota.

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. South Dakota Property Tax Records. This surpasses both the.

Roberts County South Dakota. The median property tax in Hyde County South Dakota is 987 per year for a home worth the. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in.

The portal offers a tool that explains how local property tax rates are calculated as well as. Then the property is equalized to 85 for property tax purposes. All property is to be assessed at full and true.

The median property tax also known as real estate tax in. Across South Dakota the average effective property tax rate is 122. The median property tax in Custer County South Dakota is 1554 per year for a home worth.

Across South Dakota the average effective property tax rate is 122. If the county is at 100 of full. The taxing authorities then apply an 85 equalization ratio to get the propertys taxable value.

Determine the Taxable Value of the Property.

2 4 Tax Increase On The Way For Sioux Falls Property Owners

Property Taxes In The Us A State By State Look At What You Ll Pay

Historical South Dakota Tax Policy Information Ballotpedia

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Are There Any States With No Property Tax In 2022 Free Investor Guide

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Property Tax South Dakota Department Of Revenue

How High Are Property Taxes In Your State Tax Foundation

Understanding Your Property Tax Statement Cass County Nd

States With The Lowest Property Taxes 2022 Bungalow

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State Tax Treatment Of Homestead And Non Homestead Residential Property

South Dakota Property Tax Calculator

Duvall Stands By Vote For Higher Sales Tax Downplays Vote Against Repealing Food Tax Dakota Free Press

South Dakota Taxes Business Costs South Dakota

Understanding Your Property Tax Statement Cass County Nd

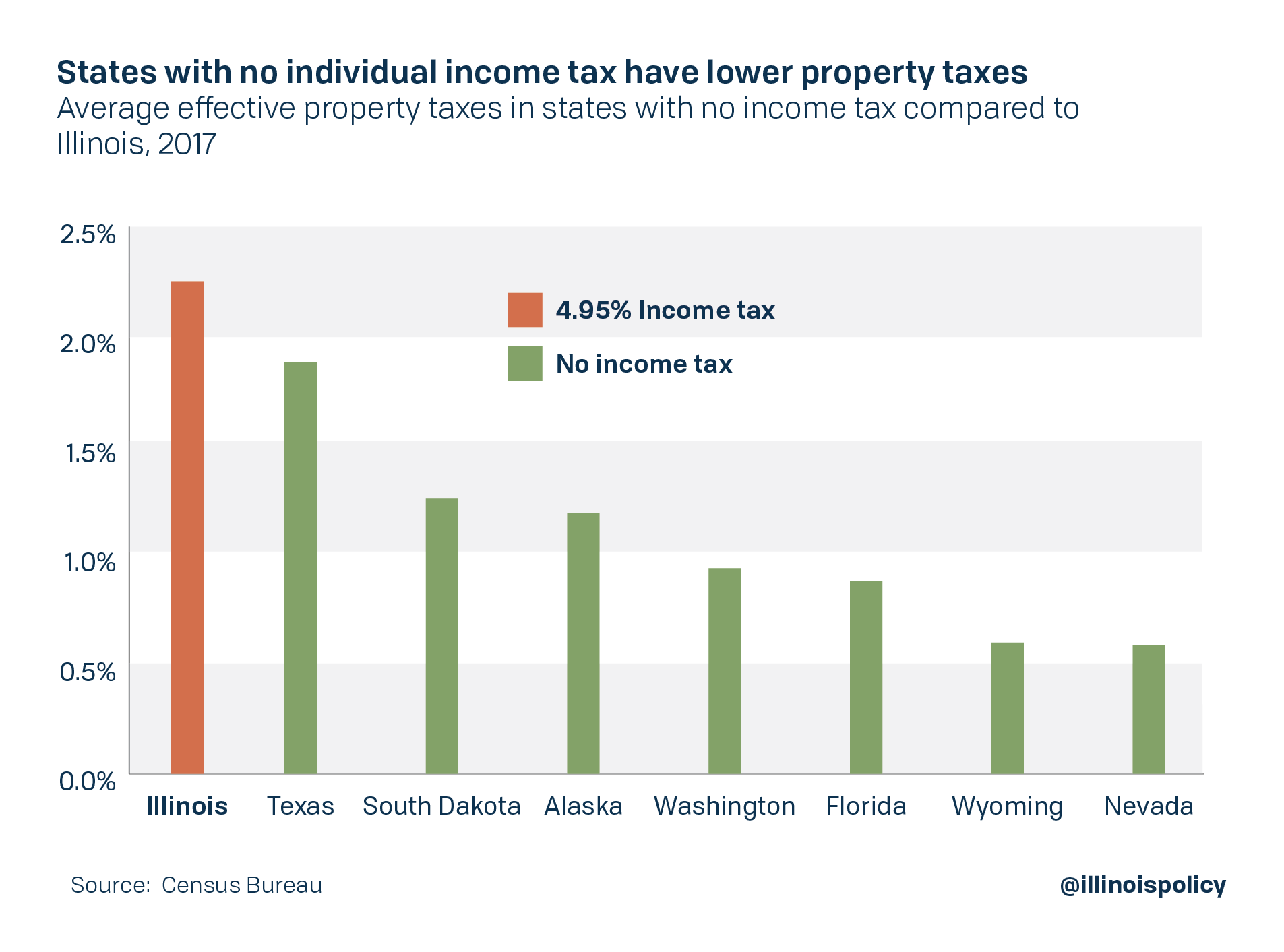

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running